Tax Extensions Coming to an End? We Can Help!

Did you have to file for a tax extension this year? Are you still putting it off because it's no easier now than it was during tax season? Depending on your extension, time might be running out!

Did you have to file for a tax extension this year? Are you still putting it off because it's no easier now than it was during tax season? Depending on your extension, time might be running out!

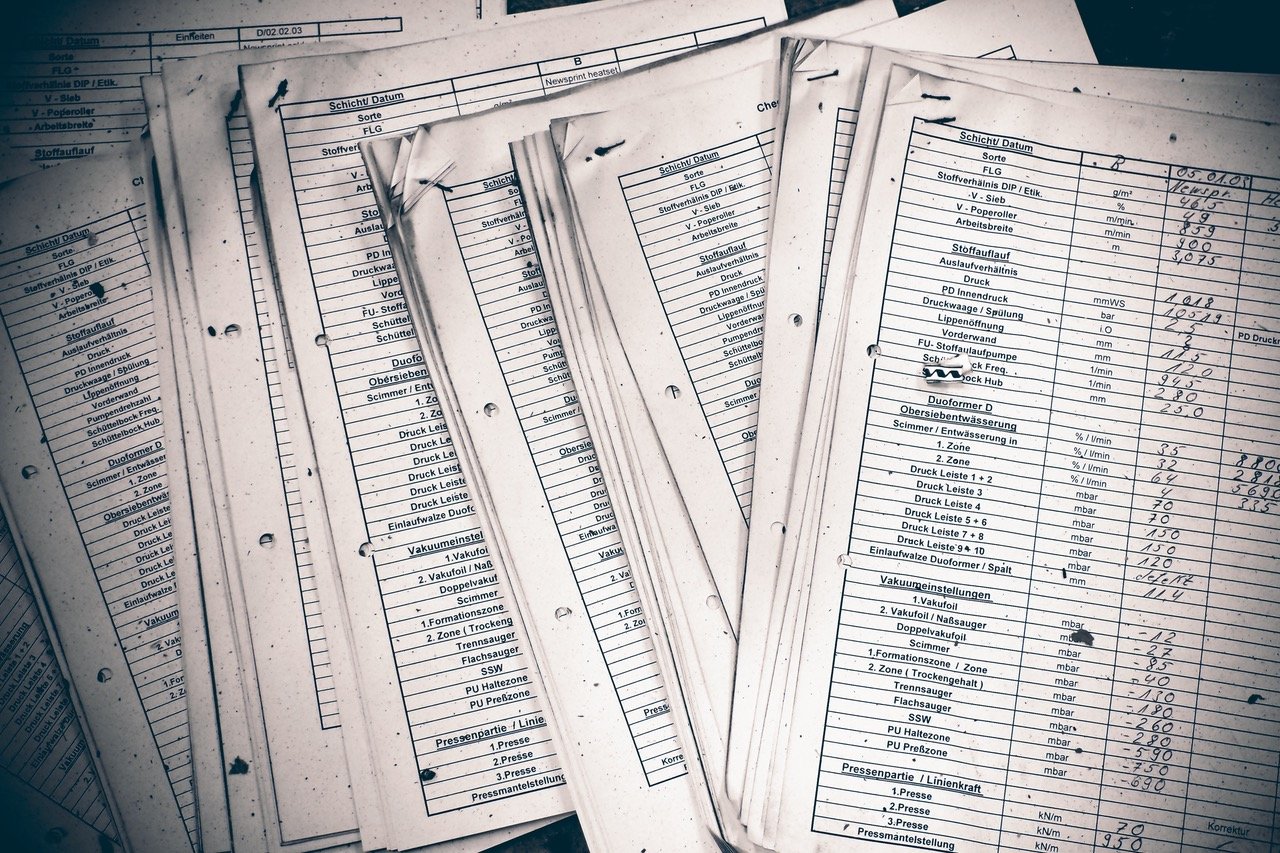

Tax extensions are a good way to buy yourself some time to get all of your paperwork in order, without paying late fees, but they tend to be a good excuse for small business owners to procrastinate. You tell yourself the extension will help you get organize, but what often happens is the job just gets put off longer and gets harder over time.

There are two-month and six-month tax extensions, meaning you have until June 15th or October 16, 2017 to complete your 2016 tax returns. Both dates will be here before we know it!

During this extension, you will have time to get the documents together and file properly. However, just because you extended the due date, it doesn't give you any more time to pay the taxes you owe. The money should have been paid on April 18, 2017. If not, you will likely face penalties and interest on the back taxes.

It's best to finish and submit your taxes to not only get it off your plate and out of the way, but also so you're not incurring any additional interest or fees on the money owed.

If you're struggling to get your company's books and financial statements in order to file your taxes, let Tally Services help! We'll help you sort everything out and get it in order so your tax professional can submit the return quickly and easily. You'll feel much better having it done and out of the way.

Contact us today for more information about how we can help prepare your books to file before the extension deadline is knocking on your door!